The Architecture of the Intelligence Layer

Modular, API-first, and built to orchestrate. Deploy the capabilities you need, across capital lifecycle, from deal execution to fund management, without disrupting your core systems.

The Agnostic Hub for Your Capital Ecosystem

We are not another silo. We are the central, agnostic hub that connects you to the partners you already trust. Our API-first architecture is designed to provide a single source of truth and a seamless flow of information across your entire deal ecosystem, ensuring you remain in full control.

For: Founders, CEOs, and Operating Companies.

The foundation for a successful raise. This layer provides the tools to structure company data, prepare for institutional diligence, and manage the fundraising pipeline efficiently. It transforms raw company information into a professional, investor-ready package.

Key Capabilities:

Standardized Issuer Intake: Structured data schemas for comparability across all submissions.

Readiness Scorecards & Gates: Auto-check completeness and KPI sufficiency so only IC-ready packets advance.

Diligence-Ready Packaging: Pre-structured data rooms plus teasers/one-pagers.

Engagement Tracking & Signals: Surface insights to prioritize outreach and stakeholder paths.

For: GPs, Deal Teams, and Independent Sponsors.

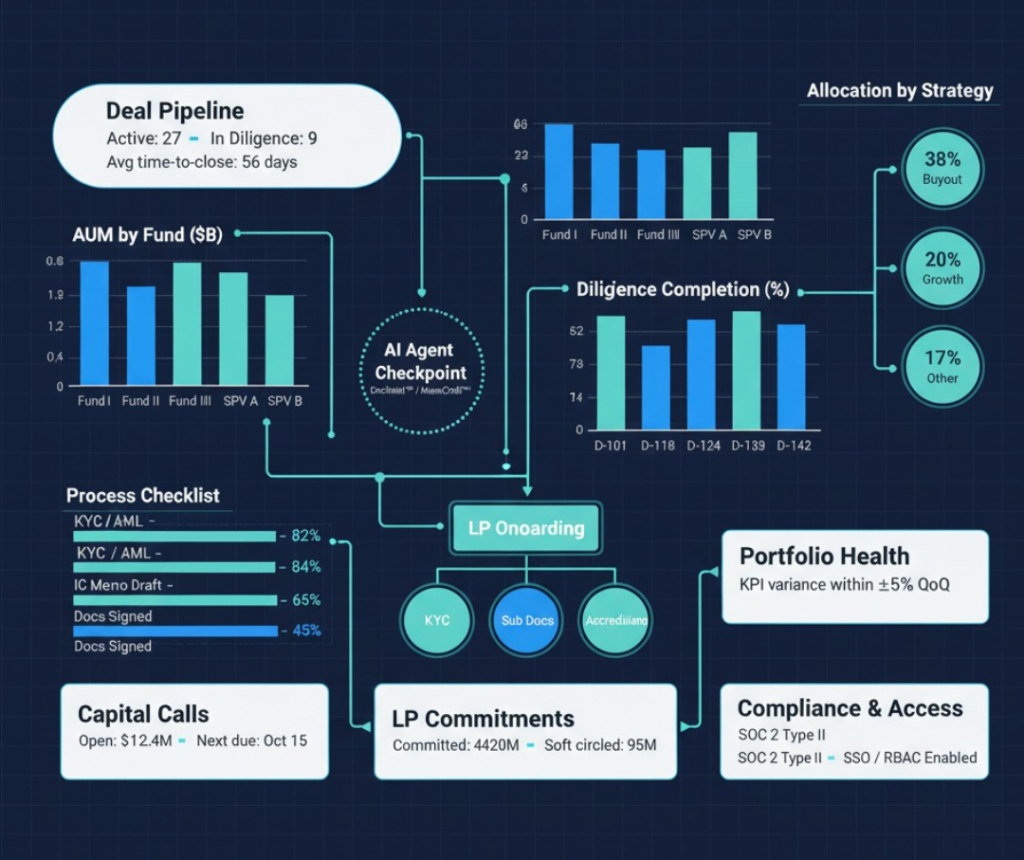

This layer provides end-to-end workflow automation for the entire deal lifecycle. Our readiness kits leverage AI to structure data, establish an auditable diligence trail, and prepare institutional-grade deal packages for secure distribution.

Key Capabilities:

AI-Powered Deal Readiness: Use agents like TeaserGen™ to auto-create materials.

Intelligent Diligence: Deploy DocIntel™ and IPBrief™ to analyze risks in hours, not weeks.

Automated IC Memos: Generate first drafts with MemoCraft™.

Secure Distribution: Branded data rooms with granular access and engagement analytics.

For: GPs, Family Offices, and Fund Managers.

Orchestrate post-close operations from a single pane of glass. This layer automates LP onboarding, capital calls, and reporting workflows, providing intelligent oversight while your administrator remains the system of record and custodian of funds.

Key Capabilities:

Automated LP Onboarding: Orchestrate KYC/AML workflows with your chosen providers.

Capital Call & Distribution Management: Automate notifications and track status in real-time.

Portfolio Intelligence: Use PortMonitor™ for live KPI tracking and risk alerts.

Seamless Transition: Our “1-Click Transition” ensures all deal data flows seamlessly from diligence to portfolio management.

Schedule a private architecture workshop to map our infrastructure to your firm's specific operational challenges and strategic goals.

DueDash is not a broker-dealer, investment adviser, transfer agent, custodian, or placement agent and does not provide legal, tax, or investment advice. All document execution, KYC/KYB, cash movement, and registers are operated by the client’s appointed administrator or licensed partners. DueDash surfaces statuses and records an audit trail for coordination purposes only.