Read this incredible PDF I threw at your face and invest in me! This is how the interaction with many founders feels like for investors. There is this expectation that one simple document is gonna open the path to immediate investment. In reality founders have to understand why the deck matters and how to share it in an effective manner. Otherwise, you might be lossing out on vital insights.

Basics: What you need to know

Before diving into the specifics of sharing your pitch deck with potential investors, it’s crucial to understand what a pitch deck is and its significance in the fundraising process. A pitch deck is essentially a concise presentation, often created using PowerPoint or similar software, designed to provide a snapshot of your business to potential investors. Its primary purpose is to tell your startup’s story and data in a way that is compelling, clear, and concise, capturing the essence of your business model, the problem it solves, the market opportunity, and your strategy for success.

Building a pitch deck is a common initial step for investor relations, requiring careful consideration of content, design, and delivery. It should articulate your business’s value proposition, the uniqueness of your solution, the size and potential of your target market, your competitive advantage, and your financial projections. Moreover, the deck should be tailored to address the interests and concerns of your intended audience, providing a solid foundation for further discussions and due diligence.

Essential components of a pitch Deck:

- Introduction: Briefly introduce your company and mission.

- Problem: Outline the problem you’re solving.

- Solution: Describe your product or service and its unique value.

- Market Opportunity: Size the market and your target customer.

- Business Model: Explain how you make money.

- Go-to-Market Strategy: Detail how you plan to capture your market.

- Competitive Analysis: Identify your competitors and your competitive edge.

- Financials: Summarize your financial projections and funding needs.

- Team: Introduce your team and their qualifications.

- Ask: Clearly state what you’re asking from investors.

When it comes to then sharing your pitch deck you have to decide how to share your data. Several methods can be employed, each with its advantages and considerations, here are the most common ones:

- Email Attachments: A simple and direct way to share your pitch deck, but it can be impersonal and lacks the ability to track engagement.

- Social Media Platforms: Can be effective for engaging with investors active on these platforms, but may not always convey the seriousness or professionalism of your approach and lacks analytics on deck usage.

- Online Forms: Used often for applications to accelerators, incubators, or open pitch events, where a more formal submission process is in place, what happens after depends on their individual process.

- Dedicated Platforms: Services designed for startup funding and investor relations can offer more sophisticated tools for sharing your deck and tracking engagement.

This foundation not only positions your startup attractively to potential investors but also prepares you for a deeper engagement, where insights and data collected from your sharing method can guide your follow-up strategy.

Why is pitch deck sharing so important?

The ability to effectively share your pitch deck with potential investors is a critical component of your startup’s communication strategy. This process determines how well you can captivate the attention of investors, who could be pivotal for your growth. Given the massive amount of information and pitches investors receive, standing out and getting the right data insights is paramount. Choose the right channels before you start sharing. Especially as an investor can get a dozen deck each week. In a year that can pile up to a 1000 decks!

Quick sharing:

Investors are inundated with opportunities, making it essential for founders to share their business’s core quickly and effectively. A well-executed pitch deck that is easily accessible allows you to cut through the noise, presenting your value proposition in a manner that is both engaging and leads to the next conversation. This efficiency is crucial in capturing and retaining investor interest in a competitive landscape.

Informed decision-making:

Investors need a data basis to judge if you are good fit for them. From their thesis over requirements to assessing your potential. If data is missing or they are unsure they might not ask for further input but rather see this as a sign that it would be unwise to move forward with you.

Actionable insights:

Gathering analytics on how your pitch deck is received (e.g., which slides are most viewed, the average time spent on each slide) can provide invaluable feedback. This data allows founders to iterate on their pitch, focusing on areas of high interest and adjusting parts that may not be resonating. Operating without this insight is like flying blind, missing opportunities to refine your approach based on real investor engagement.

Meeting investor expectations:

Investors look for clarity, conciseness, and the ability to understand a business quickly. A well-shared pitch deck demonstrates that you value their time and have a clear vision. This approach sets the tone for future interactions, showing potential partners that you are professional, prepared, and proactive.

Driving the relationship:

The process of sharing your pitch deck is just the beginning of a relationship with potential investors. How you share it, follow up, and engage based on the data collected signals your commitment to the partnership. It’s an opportunity to demonstrate diligence, responsiveness, and the kind of proactive engagement that investors appreciate in founders they choose to back.

What do investors expect?

Investors seek clarity, insight, and potential in the startups they consider for investment. When it comes to pitch decks, their expectations revolve around not just the content but also the accessibility and presentation of the information. These expectations are not just preferences but necessities, given the volume of proposals they review – remember here the 1000 decks in a year. A pitch deck that meets these criteria stands a better chance of capturing their interest and, ultimately, their investment.

Clarity and conciseness:

Investors expect a pitch deck to be a clear and concise document that gets to the point without unnecessary fluff. A deck should ideally be between 10 to 15 pages, each dedicated to conveying a specific aspect of the business succinctly. This focus ensures that investors can quickly grasp the essence of your startup, its market potential, and why it deserves their attention and resources.

Ease of access:

Accessibility is key. Investors appreciate a simple, straightforward way to access and review your pitch deck. Whether it’s a direct link, a downloadable file, or a platform that allows for easy viewing, the process should be frictionless. This convenience reflects well on your startup’s understanding of user experience and professionalism.

Founder-driven exchange:

While investors may express interest or ask questions, they expect founders to drive the conversation forward. This proactive approach demonstrates leadership and shows that you are serious about your business and the potential partnership. It’s about taking the initiative to follow up, provide additional information, and engage in meaningful discussions.

Feedback and iteration:

Investors may provide feedback or request additional data. A responsive founder who can iterate on their pitch deck or business model based on this input shows adaptability—a highly valued trait.

Typical issues & challenges founders face

Creating a deck and sharing it seems easy at first but there are many ways founders can sabotage themselves, especially when it comes to sharing your pitch deck. Recognizing these common pitfalls can prepare you to avoid them, enhancing your chances of making a meaningful connection with potential investors.

Misunderstanding engagement:

Many founders mistakenly believe that simply sending a PDF of their pitch deck will be enough to excite investors and secure funding. However, this initial step is just the beginning. Engagement requires more than just viewing a document; it involves building a relationship and demonstrating the value and potential of your startup beyond the deck.

Lost data and momentum:

Relying solely on basic methods like email attachments or social media messages to share your pitch deck can result in lost opportunities to gather valuable engagement data. Without insights into how investors are interacting with your deck (which slides capture their interest, where they spend the most time, etc.), you miss out on tailoring follow-up communications and refining your pitch based on real engagement metrics.

Delayed follow-ups:

A critical mistake founders often make is not following up in a timely manner after sharing their pitch deck. Without monitoring investor engagement, founders may miss the optimal time to reach out, losing the momentum and interest generated by the initial pitch. This delay can be the difference between securing a meeting and being forgotten.

Lack of intent and strategy:

Sharing a pitch deck should be a strategic step, not just a task on the fundraising checklist. Founders need to share their decks with intent, understanding the importance of each share as a potential entry point into a valuable investor relationship.

Benefits of DueDash

Sharing your deck and getting relevant analytics should be easy and so we enable you to do that on DueDash. Once you set up your document you an easily start engaging investors and get the data you need to follow-up timely and efficiently and increase your odds of success.

Key Benefits of Using DueDash:

- Detailed analytics: Founders gain access to comprehensive analytics, including which investors viewed their deck, their contact information, frequency of views, specific slide engagement, and time spent on each slide. This detailed data allows for a more targeted follow-up strategy, ensuring that you can prioritize outreach to the most engaged investors.

- Prioritized investor outreach: With insights into investor engagement, founders can tailor their communication, focusing on those who have shown the most interest in their pitch.

- Efficiency and time-saving: By centralizing the pitch deck sharing process on DueDash, founders streamline their outreach efforts. Our platform allows for easy sharing across multiple channels, ensuring that the deck is accessible to a broad investor audience while minimizing the administrative burden on the founder.

- Enhanced outcomes with investors: The insights provided empower you to refine your pitches based on investor interests and feedback. This informed approach can significantly improve the chances of securing investment by aligning the pitch more closely with investor expectations and interests.

- Material improvement: The analytics offer you feedback on your pitch deck’s content and structure. Founders can see which slides are most engaging and which may need revision, allowing for continuous improvement of the pitch material based on actual investor behavior.

How to use DueDash

It takes mere minutes to get started, upload your deck and start sharing!

Steps to share your deck via DueDash:

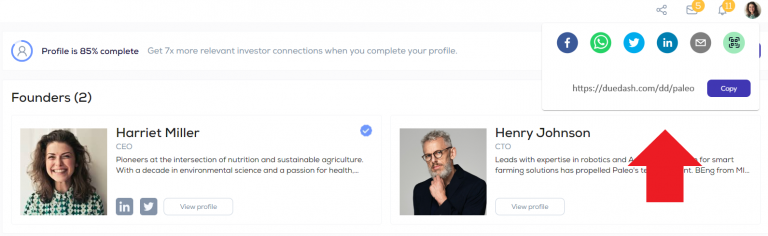

- Create your profile: Begin by setting up your DueDash account.

- Upload your pitch deck: Import your pitch deck into your DueDash data room.

- Copy your public profile link: Once your pitch deck is uploaded, DueDash generates a public profile link. This link is your gateway to sharing your pitch deck with potential investors across various platforms, from direct emails to social media posts.

- Start sharing with investors: Utilize the public profile link to share your pitch deck broadly. This can include sending it directly to potential investors, incorporating it into your email signature, or sharing it through your network on social media and professional networking sites.

- Monitor investor engagement: As investors begin viewing your pitch deck, DueDash provides real-time analytics on their engagement. You’ll receive data about who is viewing your deck, how much time they’re spending on it, and which slides are capturing the most interest.

- Review analytics inside DueDash: Dive deeper into the analytics to understand the nuances of investor engagement. This data is crucial for refining your pitch and identifying the most interested investors for follow-up.

- Follow-up based on usage: Armed with insights reach out to investors who have shown significant interest in your pitch. Tailor your follow-up messages based on the analytics, highlighting aspects of your startup that resonated the most with them.

Start sharing your deck strategically

With DueDash, sharing your pitch deck and analyzing investor interactions becomes a streamlined, insightful process. Whether you’re preparing to share your pitch deck for the first time or looking to refine your approach based on detailed analytics, DueDash offers a tailored solution to meet your needs.