Again it has been 8 months since you updated your KPIs, your investors are asking for updated information and you start wondering where to pull that info even from?

Many founders don’t know how to properly organize, and track their core data & metrics and thus fail to showcase to investors how their business is doing and convince them to back their startups.

By keeping track of important data and metrics, startups are able to not only prepare for investor engagement but excel at it as well as make better-informed business decisions.

Let’s explore how data management and progress tracking can enhance your startup’s trajectory.

What is data management in investor relations?

Data management and tracking of data are crucial processes for startups, involving the collection, structuring, and analysis of information relevant to investment processes and internal development. One key aspect of this involves core data such as the 5Ts: Team, Timing, Traction, Technology, and Total Addressable Market (TAM), out of which Key Performance Indicators (KPIs) can be created as well.

Startups utilize this data to gauge their progress, identify challenges, and establish a baseline for making strategic decisions. By tracking metrics related to team performance, market timing, customer traction, technological advancements, and market size, startups gain insights into their overall performance and areas for improvement.

Further, startups often share this data with investors as part of due diligence and reporting processes. Investors rely on this information to evaluate the startup’s potential, assess its trajectory, and make informed investment decisions. By providing transparent and comprehensive data, startups can build trust with investors and strengthen their relationships, ultimately facilitating successful fundraising and growth opportunities.

Essentials of data management for founders:

- Core data such as your 5Ts: Team, Timing, Traction, Technology, and TAM data

- Strategic Metrics (KPIs): Key indicators highlighting the performance of the business

- Data room: Due diligence and other relevant investor documents are stored as a structured overview of the business.

Why is data management important?

Data management and the tracking of relevant information are essential for founders to monitor progress over time and make any required adjustments along their fundraising journey. Data management is integral for a strategic and responsive fundraising journey and investor relations, ensuring founders can adapt to changing dynamics and maximize their impact in reaching any investor goals.

Informed decision making

Proper data management allows startups to assess their progress accurately and identify any challenges they may face along the way. By analyzing various metrics and trends, founders can make informed decisions to steer their company in the right direction.

Investor engagement preparation

Efficient data management ensures that founders have all the necessary facts and figures ready when engaging with investors. This includes financial reports, market analysis, and any other relevant data that investors may require to evaluate the startup’s potential.

Expedited due diligence

Clear and organized data preparation expedites the due diligence process with investors. When all relevant information is readily accessible and well-presented, investors can quickly assess the startup’s viability and make timely decisions regarding investment opportunities.

Real-time insights

Regular tracking of Key Performance Indicators (KPIs) provides investors with real-time insights into the startup’s performance. This allows investors to stay updated on the company’s progress and ensures that the startup remains top-of-mind when considering investment opportunities.

Building trust

The combination of data readiness, ongoing KPI tracking, and cohesive presentation builds trust with investors. When founders consistently provide accurate and transparent data, it demonstrates reliability and professionalism, enhancing investor confidence in the startup’s potential for success.

Relationship strengthening

Effective data management not only attracts potential investors but also deepens relationships with existing ones. By maintaining open communication and providing regular updates on progress, founders can strengthen trust and loyalty among investors, paving the way for long-term partnerships and continued support.

What is expected?

Investors expect meticulous data management practices from founders. A high standard of data management demonstrates professionalism and instills confidence in investors, allowing them to make informed decisions based on reliable information.

Professionalism in data handling

Investors demand professionalism in data management from startups. This includes having robust systems and processes in place to collect, organize, and share data efficiently. Startups must invest in reliable data management tools and establish clear processes to ensure data accuracy and accessibility.

Regular data sharing

Investors expect founders to proactively share tracked data regularly, typically monthly or quarterly. Consistent reporting allows investors to stay updated on the startup’s progress and make informed decisions about their investments. It also demonstrates the startup’s commitment to transparency and accountability.

Clarity and transparency

Transparency is key in investor-founder relationships. Investors value clarity and honesty in all communications, particularly when it comes to sharing financial and operational data. Any attempts to conceal or manipulate information can erode trust and damage the startup’s reputation. Startups should prioritize open and honest communication to build strong, long-lasting relationships with investors.

Mitigating risks

Dishonesty or lack of transparency can pose significant risks to founders. Investors rely on accurate and reliable data to assess the startup’s performance and potential. Misleading or incomplete information can lead to misunderstandings, legal issues, and even loss of investor confidence. Startups must prioritize integrity in data management and reporting to mitigate these risks.

Building credibility

Consistent, transparent data sharing builds credibility with investors. When founders demonstrate a commitment to openness and accountability, it enhances investor trust and confidence in the startup’s ability to deliver results. This, in turn, strengthens the startup’s position in fundraising efforts and fosters positive relationships with investors over time.

Issues & challenges:

Investors want to see a clear picture of a company’s performance, and startup data provide a standardized means of communicating this information. There are several challenges faced by startups in effectively managing and leveraging their data:

Data management challenges:

Many entrepreneurs face challenges in data management, often working with inefficient and duplicate systems. This results in improper collection, transformation, and presentation of data, leading to multiple entries and erroneous outputs. As a consequence, the startup’s appearance towards investors becomes messy, confusing investors.

Uncertainty in technology usage:

Founders may be unsure about which systems and technologies to use, often working with limited resources that hinder them from showcasing the full potential and current stage of their startup effectively.

Lack of understanding investor needs:

Founders often lack clarity on what investors are looking for in terms of relevant data, presentation formats, and update frequency. This uncertainty can hinder investor deals and create a negative impression, despite the startup’s actual performance.

Struggles with data updates:

Many founders struggle to keep their data up to date, especially key information such as monthly KPIs. This inconsistency in data updates can undermine investor confidence and hinder effective decision-making.

Benefits of DueDash

What is the best way now to start doing your data management and tracking all the above-mentioned elements in mind? You don’t have to look far. DueDash provides complete data management and tracking functionalities. Several advantages include:

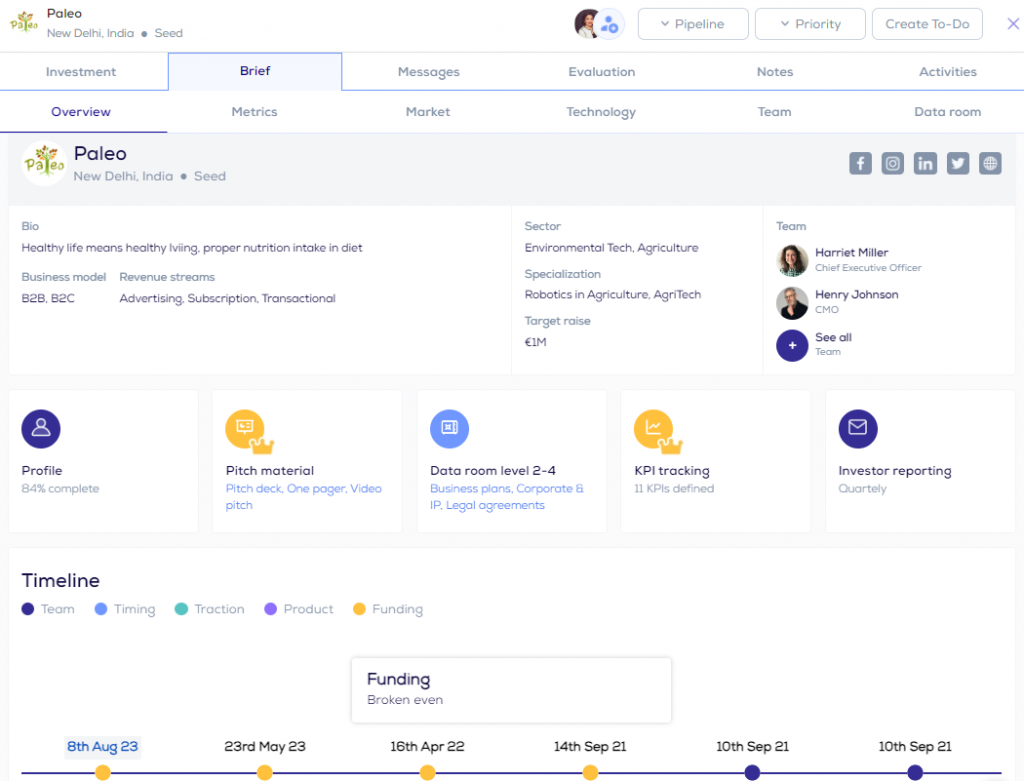

- Comprehensive Data Management System: A single system that streamlines data collection, organization, and presentation & guides startups to set up and manage all their data eliminating the need for multiple inefficient platforms.

- Effortless Information Updating: Founders can easily update their core information such as 5T and KPI data within the system. This allows founders to stay on top of their business metrics and make informed decisions promptly.

- Real-Time Monitoring and Progress Tracking: Founders can easily monitor the progress which empowers them to make the best business decisions. With real-time access to key metrics and performance indicators, founders can respond quickly to changes in the market or internal operations.

- Time and Effort Savings: A user-friendly data management system saves time and effort for startups, enabling them to focus more on growing their business rather than dealing with data management complexities.

- Centralized Investor Engagement: Centralizing investor engagement within the system incentivizes founders to keep their data up to date. Automated reminders prompt founders when information becomes outdated, ensuring that investors receive accurate and timely updates.

- Data Visualization for Clarity: The visualization of data provides founders and investors with a better and clearer picture of the startup’s current situation and future potential. Visual representations of key metrics and trends facilitate easier interpretation and decision-making.

- Building Trust through Data: Investors develop trust with founders through data-driven relationships. By providing transparent and reliable data, founders demonstrate their commitment to accountability and facilitate stronger partnerships with investors.

How to use DueDash for Data management:

Steps to start using DueDash for data management:

- Create your profile: Begin by setting up your DueDash account.

- Collect Relevant Data: Complete your DueDash profile with core data, such as the 5Ts (Team, Timing, Traction, Technology, and Total Addressable Market) and Key Performance Indicators (KPIs) under the Metrics & Funding section

- Upload Core Documents: Utilize the data room feature to upload and maintain core documents at different levels.

- Start Sharing Information: Once your DD profile is complete, start sharing information with investors. Grant access to investors using sharing your DD profile link.

- React to Investor Queries: Respond to investor questions and requests for additional information by allowing access to Data room levels or through inbuilt messaging systems.

- Send out updates: This data you collect and manage can be sent as part of investor updates, simplifying your investor reporting.

- Keep data up to date: Check back in regular intervals to keep your data current and relevant.

Start sending updates with KPIs!

Now that you know everything about data management & tracking, DueDash offers you the ability to easily manage and track your data as well as update investors all in one place. Login into your DueDash account or sign in to get started