Fundraising masterclass with Nikhil Madan

Learn the language of investors and raise funding. This will be your rocket launcher to startup success.

Session per week

Duration

Investment

Mode

Target group

This course is for you

If you say "yes" to any or all of the below questions, you are at the right place. A fundraising masterclass that you can directly apply in your current round.

Join our next masterclass

This fundraising masterclass will take place in a hybrid mode with in-person sessions in Dubai and digital learning elements.

Target group

Master the art, science and data

Fundraise like a pro

Successful startups attract VCs, and fundraisers who are skilled can raise large rounds of funding. Art and science go hand in hand with fundraising. Fortunately, fundraising can be learned.

Learn from an expert

Take the opportunity to learn from someone who has raised capital from leading entrepreneurs and venture capitalists and was a venture capitalist and angel investor on the other side of the table.

Host

Learn from an expert

Investor experience

Our host Nikhil Madan has invested in over 40 tech startups worldwide before starting DueDash. As investor and founder, he has held and heard thousands of pitches, screened over 4000 startups for his own investments and has a good understanding of mistakes and successes.

Understanding of ecosystem

He is an Electronics Engineer with a Management degree in Leadership & Sustainability and alumni of IE Business School, Spain, and Haas School of Business, California Berkeley. Previously, he worked for NTT Data (now Perot Systems).

Testimonials

What our founders are saying

Hear from other founders, how the DueDash course helped them mastering the art of fundraising.

Mattia Nuti

Founder of Vortex Biotech

Abhishek Kumar

CEO of AccelarizeBenefits

This course will help you to

Become investable

Understand how to make your business investable and communicate the investment merits of your startup.

Find investors

Find the right investors and introductions for a meeting.

Improve documentation

Incorporate the right things into your pitch deck and 3-year forecast.

Understand deal types

Navigate the technical dialogue around 3 venture deal types: convertible notes, SAFEs and priced rounds.

Define deal terms

Pay attention to these 5 key aspects of the deal terms to ensure that your equity and control are protected.

Close deals

Push the deal through to closing and start building an amazing company.

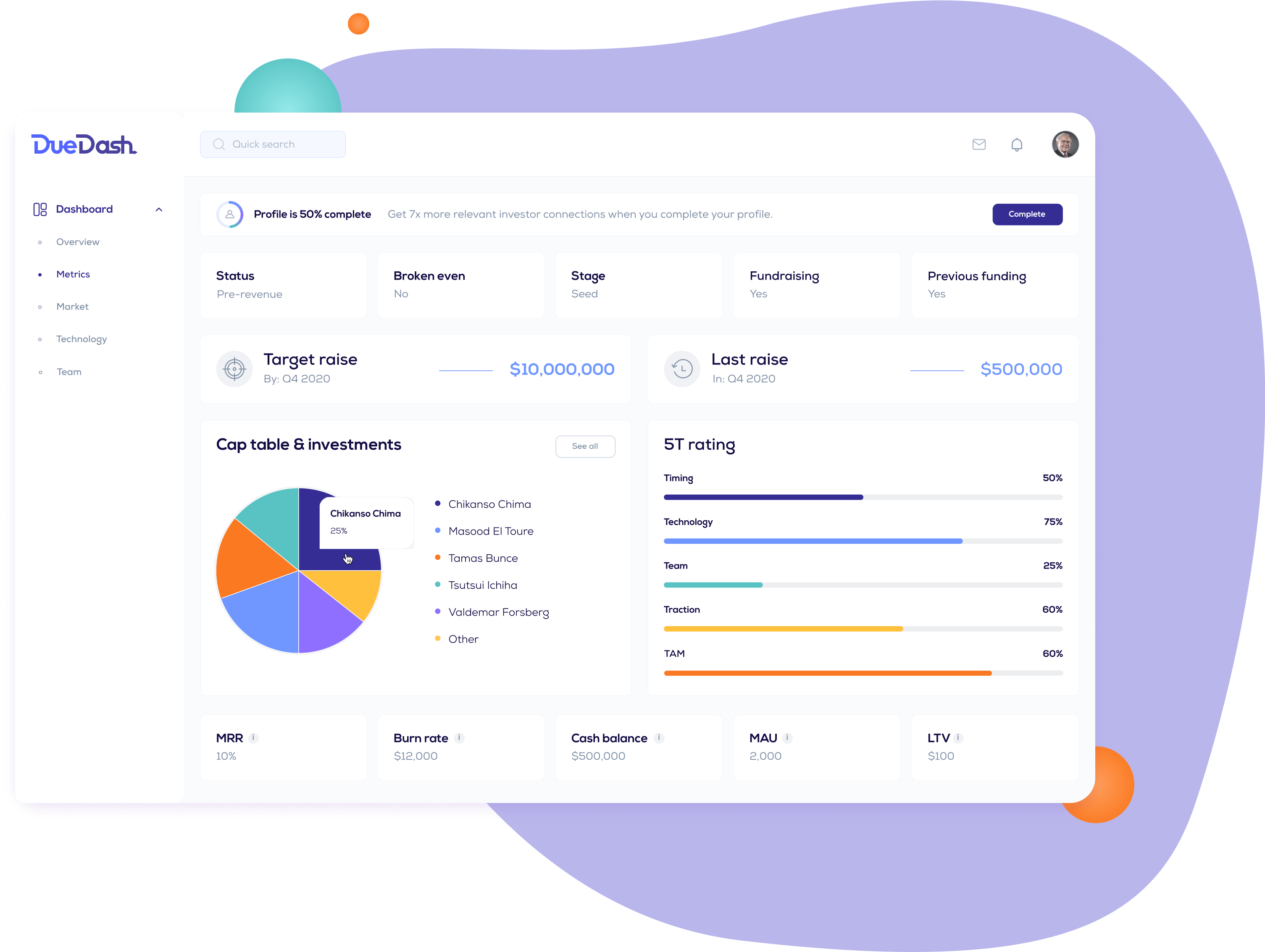

Fundraise like a pro on our investor relations platform

Apply your new knowledge to connect with investors, share your data and keep them updated about your startup's progress. All in one platform.