Fundraising is about preparing your business for investment. In your presentation, investors want to see that you are familiar with and honest about your financials.

In this article, we’ll share some important pieces of the fundraising puzzle that must be addressed. Keeping these key questions and factors in mind, you’ll be able to raise capital more efficiently for your startup.

What is the right amount to raise in my next round? How much do I need?

Every startup is different, so the cash needs for each business will differ, too. However, there is key information that investors look for when funding a business. Here are two of the most vital data points you need.

What are your startup milestones?

Milestones are targets in the lifespan of your startup that pinpoint where you plan to receive funding.

The investor wants to know if you can accurately communicate the cash needs of your startup. To communicate those needs, you must understand your company milestones.

Your milestones should also reduce key risks, show how you plan to scale, and highlight what your team is capable of.

What is your monthly burn rate?

The burn rate of your startup is equal to the amount it costs you to stay in business. How much money are you spending to stay in the black?

Your startup has a “runway”. This is the monthly amount of working capital you need to get to your next round, next exit, or grow enough profit to not need external funding.

How many months are left on your runway?

How do I relate my milestones and burn rate?

First, look at the cash amount you need to meet your monthly burn rate. This is the floor of much capital your startup requires. After that, you’ll add any projected additional costs. These costs include employees you’d be hiring, development, marketing costs, etc.

Once you have that number, multiply it by the number of months it might take to reach your next big milestone.

Be sure to include a buffer for unpredictable obstacles. This buffer is usually represented by an additional 6 months of your calculated burn rate.

You should now have a clearer financial picture of how much money you should raise for your startup. There are a few more vital things to consider when knowing how much to raise. This is why fundraising is as mental and emotional as it is financial.

What’s the consequence of receiving my requested funding amount, in terms of equity I give away?

The fundraising decision you make today could affect your startup many years into the future. This is why it’s good to have a firm grasp on your company, and its potential, before requesting equity. Let’s answer this question in two parts.

How much equity are you willing to part with?

For some founders, 50% ownership is the right amount. For others, an exit strategy is their goal. Whatever your choice, investors are likely not going to offer you free money.

If an investor offers more than you asked for, consider how much of the shares you are selling.

Will extra money dilute your business valuation?

Dilution happens when more investors inject more money into a business. Here is a great article we found from Both Sides of the Table that explains how dilution works.

Raising money usually comes with the benefit of increasing the valuation of your company. However, consider that a high valuation might not be the right thing for you at the very beginning. If you sell too many shares too quickly, you could be putting future fundraising efforts at risk.

You can pace the rate at which you’re selling shares according to the milestones you have in place.

Should I create a financial projection model?

Absolutely. Your projections should be based on repeatable and scalable data. Projections help you create recurring, predictable income. Here are two example models that we think are best.

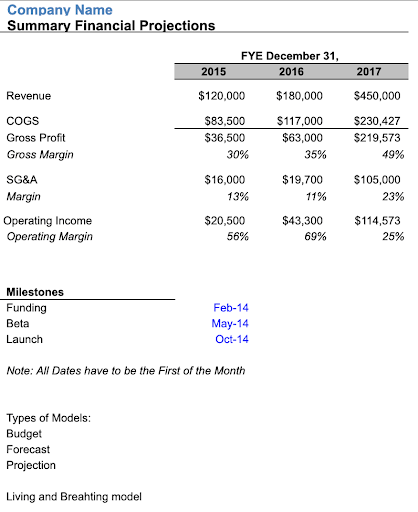

Jeff Wald’s Projection Revenue Model

This is a 3-year model that is in-depth and straightforward. Here you’re presenting your cash needs, breaking down your burn rate, and including revenue assumptions. But first, you’ll open with a quick summary of your revenue projections for the next three years.

For this you’ll need to know your revenue and costs of goods sold to calculate your gross profit. Then you’ll need your SG&A, operating income, and your milestones. Here’s what that looks like:

Throughout the rest of this model, you’ll be adding in the micro details of your expected burn rate. Everything that you can, identify it in your payroll, marketing spend, the specifics of your COGS.

Here is a template of the Jeff Wald Projection Revenue Model to help you get started.

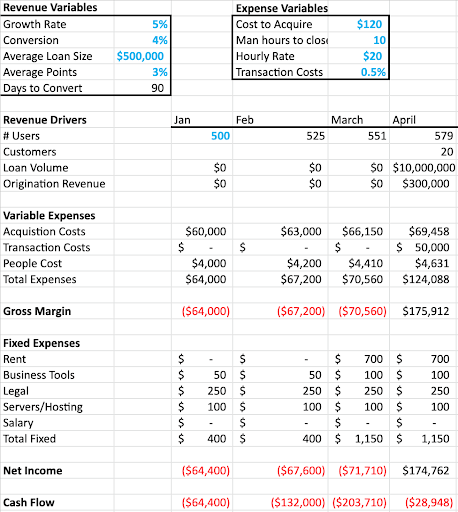

Matt Rodak’s Sample Revenue Model

This model is great if you’re not at a stage where you can make specific assumptions or projections. It’s perfect if you’re new or have a variable revenue model. Or, if you plan to fundraise more than once per year.

In this projection, we are looking at one full year of business through cash flow. You’ll need to know your variable expenses, fixed expenses, and revenue drivers. Here’s how that looks:

New and smaller startups should find this projection model useful. It is not too detailed, doesn’t expect too much, but gives a quick and honest look at your revenue, costs, and cash flow throughout the year.

This is also what investors are looking for if you’re planning multiple rounds of fundraising in one year.

Here is a template of the Matt Rodak Projection Revenue Model to help you get started.

Determine your terms of the fundraising round

Based on your milestones, burn rate, and financial projection model, you should aim to raise enough money to support your company for the next 18 to 24 months.

Raise too much money, and you risk dishonest spending. But raise too little, and you could end up giving away too much equity.

Do not over ask. Over asking is the #1 killer of success. Always ask for what you need, and let the market push you toward more.

Enjoy the startup journey

Fundraising doesn’t have to be nerve-wracking. Once you arrive prepared for the negotiation table, you are on the right path to achieving your startup’s financial goals.

Receiving your requested fundraising is an exhilarating experience. Remember to be flexible and appreciate the wild ride of owning a startup.