In this article, I want to talk about the VC investment process to give you an idea of how the investment process goes on. There are some steps that can be different depending on the VC. First of all, a quick note about the fund life and investment period.

VC funds have a fund life of 10 years and can have an extension of 1-3 years more. Usually the fund life is denoted as 10+1+1 meaning that the life of the fund can be extended to 2 more years but for each year the partners of the fund need to have the consent of the limited partners to extend fund life.

The next point I am going to talk about is the investment period. Typically, a fund has an investment period of 3-5 years. During this investment period the fund actually selects all the companies that they will have in their portfolio. For example, a pre-seed focused fund wants to have a portfolio of 25 companies and has an investment period of 4 years.

Then, in the first year they might cut their first cheque to 6 companies, similarly 6 new companies in the second year followed by 6 new companies in the third year and remaining 7 in the fourth year.

Now, this doesn’t mean that the fund has exhausted all of its capital in those 25 companies. Depending on the fund strategy about 40%-51% of the total committed capital is invested during the investment period.

The remaining capital is reserved for follow-on investments in the same 25 companies. The funds do so in order to maintain their equity position in later financing rounds. Not all 25 companies are going to get follow-on investments, only the ones which show growth potential tend to get follow-on investments.

So, if you are a founder and you approach a fund that seems like the perfect fit for your company in terms of alignment with the investment thesis of the fund and you also have the apt KPIs and the fund says no then there is a possibility that you approached the fund after the investment period is over.

Of course, there can be other reasons as well.

Now let’s get back to the investment process starting with the pitchdeck. The objective of your pitchdeck is not to get an investment decision from a VC straight up but to grab their interest and get a meeting with them.

Depending on the firm size and structure, you might be contacted by an analyst or associate or in some cases even the partner for a call. The VCs prepare an internal document which is regularly updated with details about your company and also minutes of the meeting.

After the initial meetings, VCs will use some factors to screen your company and can either reject or invite you to their offices to pitch on a Monday. The figure below shows broadly the screening pointers used.

This is part of the so called “Monday Morning Meetings” where VCs have 3-6 pitches followed by questioning. If they decide to move forward then they conduct a soft due diligence where they try to validate your market, assumptions, product based on their experience.

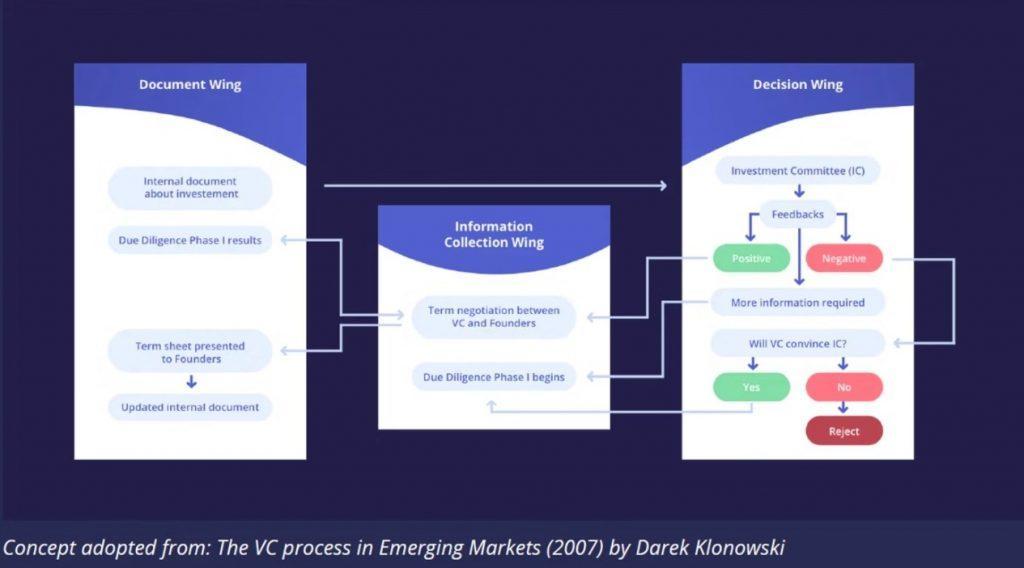

For the next phase of due diligence the VCs prepare a list of questions that they will send to the founders or management of the company and also ask for some documents such as certificate of incorporation, cap table, compliance and regulatory approvals etc.

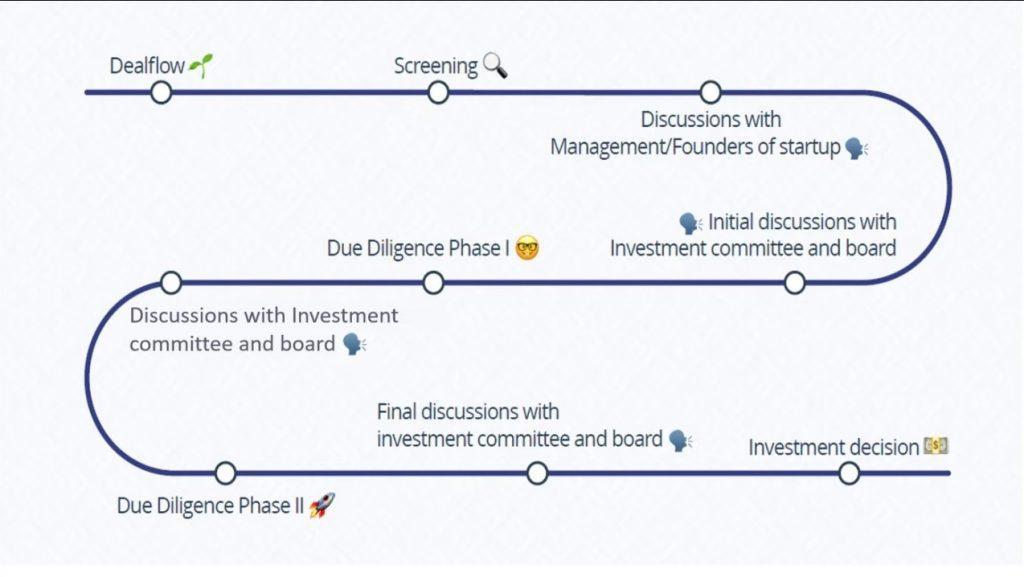

The figure below so a rough breakdown of first phase of the investment process.

A term sheet is also presented and the negotiations begin. The findings are updated in the internal document and a discussion with investment committee and supervisory board takes place. The supervisory board consists of people appointed by the limited partners of the fund and have an advisory role rather than a decision making role.

At this point, the investment committee can take the decision to reject the investment or move on to the next phase. In the next step the investors incur costs as they involve technology consultants, lawyers, auditors etc.

The figure below is a rough breakdown of second phase of the investment process-If the investment committee is satisfied with the results of second phase of due diligence and agree with the terms then the investment will be made.

Thank you for reading my article.

Gautam Kumar

Pre-Seed - Seed Investments | Sector Agnostic | VC Research | Startup Mentor